SBP receives $1.1 billion IMF loan tranche

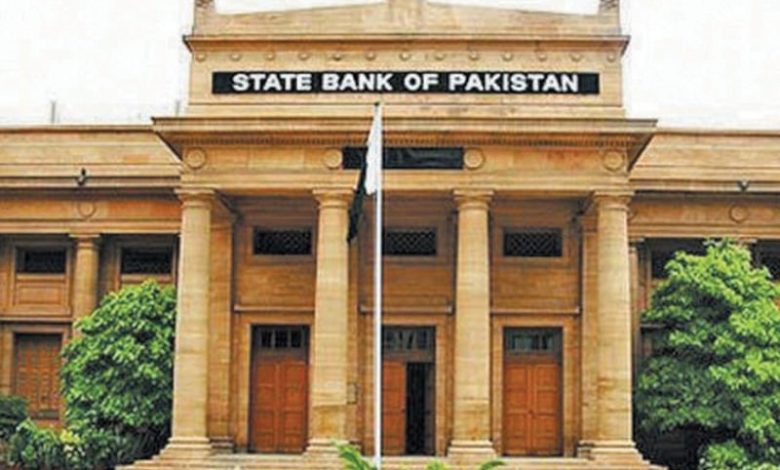

KARACHI:Pakistan’s central bank reported on Tuesday that it had received the International Monetary Fund (IMF)’s last tranche of $1.1 billion, which took the cumulative inflows to $3 billion in 10 months at the conclusion of a standby arrangement (SBA).

The latest inflows have apparently pushed the country’s foreign exchange reserves, held by the State Bank of Pakistan (SBP), to around $9 billion, stabilising the rupee against the US dollar.

Previously, the reserves remained stable around $8 billion over the past two months despite the repayment of a major foreign debt of $1 billion in mid-April 2024. The reserves, however, extend import cover for less than two months only.

Finance Minister Muhammad Aurangzeb has projected that the reserves will rise to $9-10 billion by the end of current fiscal year on June 30, 2024.

The IMF’s executive board granted its approval for the release of the last tranche on Monday. Earlier, a staff-level agreement was reached in mid-March 2024 after the lender successfully completed the last review under the SBA.

In a statement, the SBP confirmed that it had received SDR 828 million (equivalent to around $1.1 billion) from the IMF. The amount will reflect in the SBP’s reserves for the week ending on May 3.

It was the second IMF loan package that the country completed in the past eight years. Last time, it successfully implemented a $6 billion Extended Fund Facility (EFF) from 2013-16. But it again had to seek a bailout package in 2019, which ended inconclusively in June 2023.

In June 2023, Pakistan signed a nine-month $3 billion SBA, which stabilised the economy and brought the current account deficit under control. However, the budget deficit remained elevated and is going to reach 7.4% of gross domestic product (GDP) as per IMF’s estimate.

In a commentary titled “Economy: sustained policy and reforms critical for sustainable growth”, Akseer Director Research Muhammad Awais Ashraf said, “In addition to extending the reform effort (under the $3 billion SBA), the IMF continues to highlight fiscal management and keeping the first line of defence intact through a market-determined exchange rate to achieve sustainable economic growth.”

The energy sector has stabilised through timely tariff rationalisation along with enhanced recovery efforts. Now, the IMF calls for cost-side reforms, which are the key to addressing the sector’s underlying issues besides adhering to the ongoing measures, he added.

However, others noted that the withdrawal of subsidy on petroleum products and increase in power and gas tariffs under the SBA put significantly more burden on the people, who were also forced to pay higher taxes.

In addition, the SBP lost its autonomy to the IMF and it could not be able to lower the key policy rate despite a marked fall in the current inflation rate and the forward-looking rate.

In spite of the IMF programme, Pakistan could not attract sufficient inflows of foreign debt. As a result, the central bank had to resort to dollar purchases of over $5 billion from the market to keep the reserves stable around $8 billion.

Also, the international credit rating agencies did not improve Pakistan’s ratings in spite of the successful completion of the IMF programme. The risky ratings kept foreign private lenders away from Pakistan.

The IMF noted that Pakistan’s economic and financial position had improved in the months after the first review. It added that growth and confidence in the country continued to recover on the back of prudent policy management as well as the resumption of inflows from multilateral and bilateral partners.

For the ongoing fiscal year, the government has set the GDP growth target at 3.5% and the inflation goal at 21%. The last IMF report showed that Pakistan’s economy might grow by 2% and its inflation rate would hover around 25%.

Published in The Express Tribune, May 1st, 2024.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.